#1 Full & Final Settlement Software

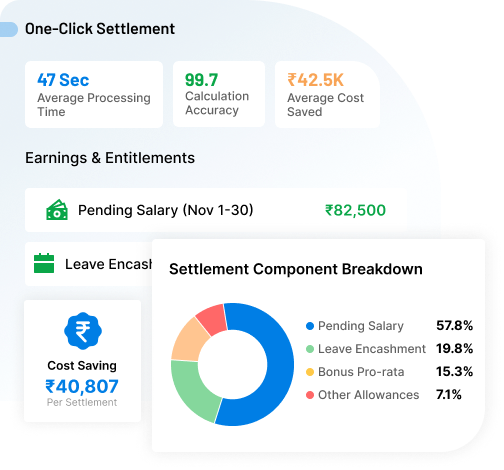

Settle Employee Dues in Minutes, Not Days

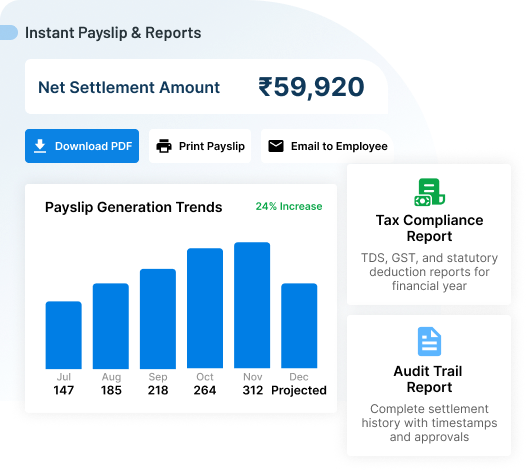

Say goodbye to manual calculations and long offboarding delays. With Qandle, your HR team can automate full & final settlements, calculate every due accurately, generate payslips instantly, and keep departing employees happy, all in a few clicks.

Book a free Demo