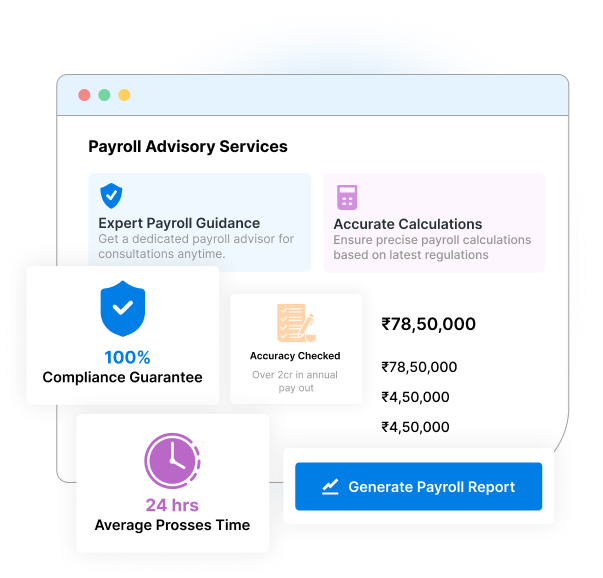

#1 Payroll Advisory Services

Take the Stress Out of Payroll, Every Time

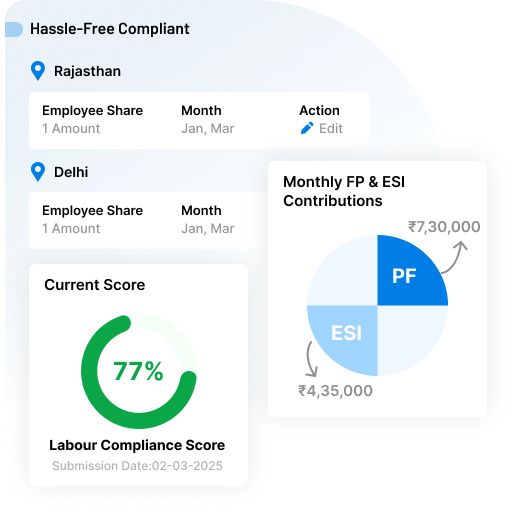

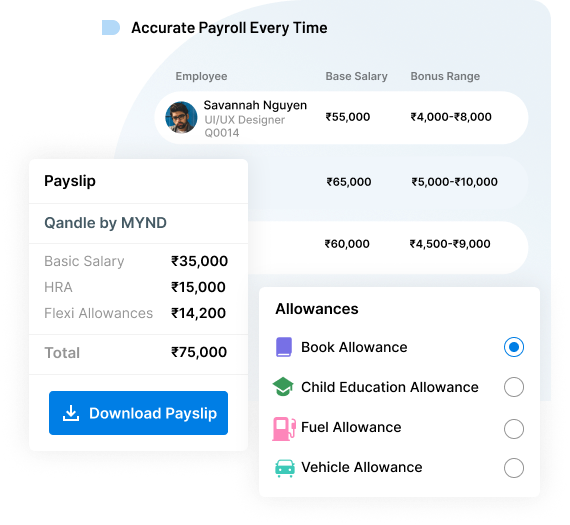

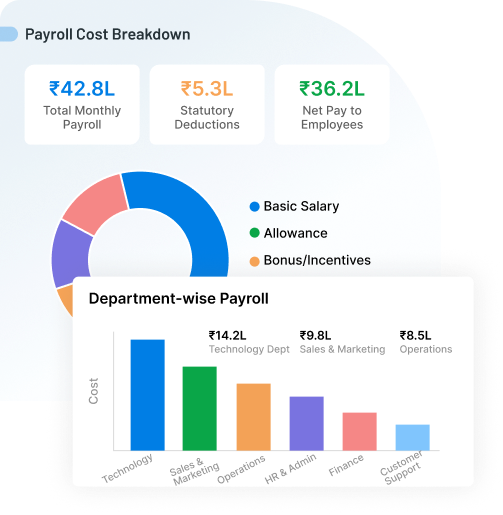

Managing payroll can be complex, time-consuming, and full of compliance headaches. With Qandle’s Payroll Advisory Services, you get expert guidance, accurate calculations, and industry-specific solutions, so your team gets paid on time, your business stays compliant, and you can focus on growth, not spreadsheets.

Book a free Demo